EVA Air actively responds to international trends by setting a net-zero emissions target. Following an inventory assessment, EVA Air’s environmental footprint derives primarily from the energy and resources used in our value chain, as well as the ecosystem of aircraft and ground operations. In response to the global climate emergency, EVA Air has established a climate governance mechanism based on the Task Force on Climate-Related Financial Disclosures (TCFD). After the formal release of the Taskforce on Nature-related Financial Disclosures (TNFD) in September 2023, the TNFD’s processes were integrated in a more comprehension manner. We introduced the concept of ecological footprints into our management in order to incorporate the Nature Positive concept to our climate action strategies.

Nature and Climate-related Risk Management

EVA Air implements nature and climate risk management by systematically identifying short-, medium-, and long-term nature- and climate-related risks. These cover aspects such as policy, technology, regulations, market dynamics, reputation, and physical climate factors. Each risk is assessed based on its potential impact and likelihood of occurrence to determine materiality. The effectiveness of risk management is regularly reported to the Sustainability Committee and the Board of Directors for review. Adaptation and mitigation measures are implemented to reduce potential impacts and enhance operational resilience. EVA Air’s boundaries for nature and climate-related risk management include the Company’s business operations, including upstream suppliers and downstream customers in the value chain, in order to comprehensively identify and manage risks from our operations.

Climate Risk and Opportunity Significance Identification

With reference to the Task Force on Climate-Related Financial Disclosures (TCFD) framework; the Carbon Disclosure Project (CDP) Climate Risks and Opportunities Project; international aviation industry trends; and international initiatives, sustainable development trends, and GHG emission control measures such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA); the European Union Emissions Trading System (EU ETS); and the United Kingdom Emissions Trading Scheme (UK ETS), EVA Air has identified eight risks and six opportunities related to climate change in the industry.

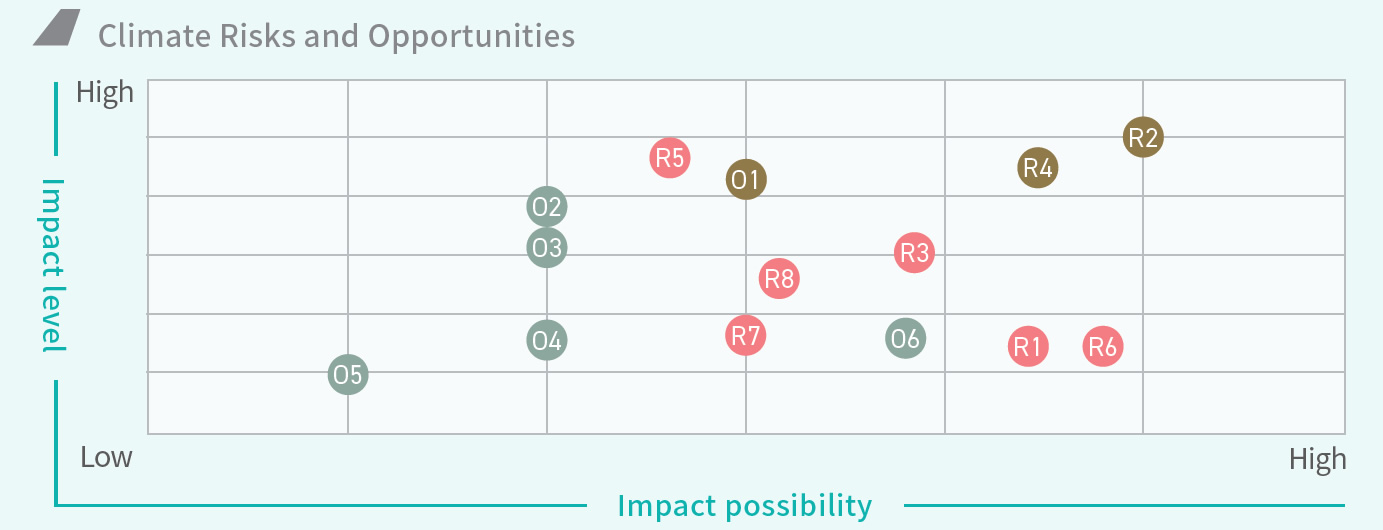

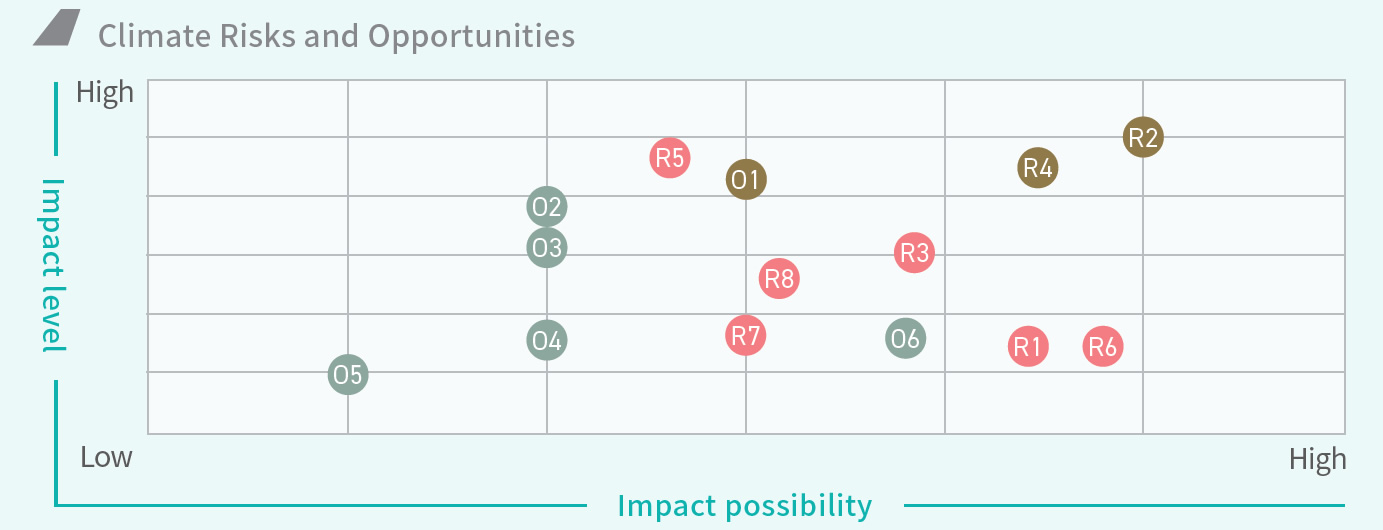

Each department assesses each climate-related risk and opportunity, in accordance with the Company’s risk management process for the risk/opportunity’s likelihood of occurrence and the level of impact; the results are then given a materiality analysis (per the EVA Air Climate Risks and Opportunities diagram). Based on the climate risk and opportunity matrix results, two major transition risk items and one major opportunity – Carbon Pricing Mechanism, Rising Sustainable Raw Material Costs, and Developing/Expanding Low-Carbon Aviation Services – were prioritized for management. Additionally, the physical risk Rainfall (Water) Pattern Changes & Long-Term/Extreme Climate Changes was identified through scenario analysis of climate change in regions where the Company and our key suppliers operate.

Climate Risks and Opportunities

|

Transition Risk

|

Physical Risks

|

Opportunities

|

| R1 Carbon Emissions Regulations in the Aviation Industry |

R6 Increased Severity/Frequency of Extreme Weather Events (e.g., Typhoons/Floods) |

O1 Developing/Expanding Low-Carbon Aviation Services |

| R2 Carbon Pricing Mechanisms |

O2 Providing Low-carbon Transport Services |

| R3 Low-carbon Transition Costs of Aviation and Operating Sites |

R7 Average Temperatures Rise |

O3 Developing Climate Adaptation Program for Aviation Industry |

| O4 Participating in Carbon Emission Trading Market |

| R4 Rising Sustainable Raw Material Costs |

R8 Rainfall (Water) Pattern Changes & Long-Term/Extreme Climate Changes |

O5 Using Sustainable Aviation Fuel |

| R5 Consumer Preference for Low-carbon Travel |

O6 Improving Fuel Efficiency Operating Modes |

Identifying Dependence and Impact on Nature

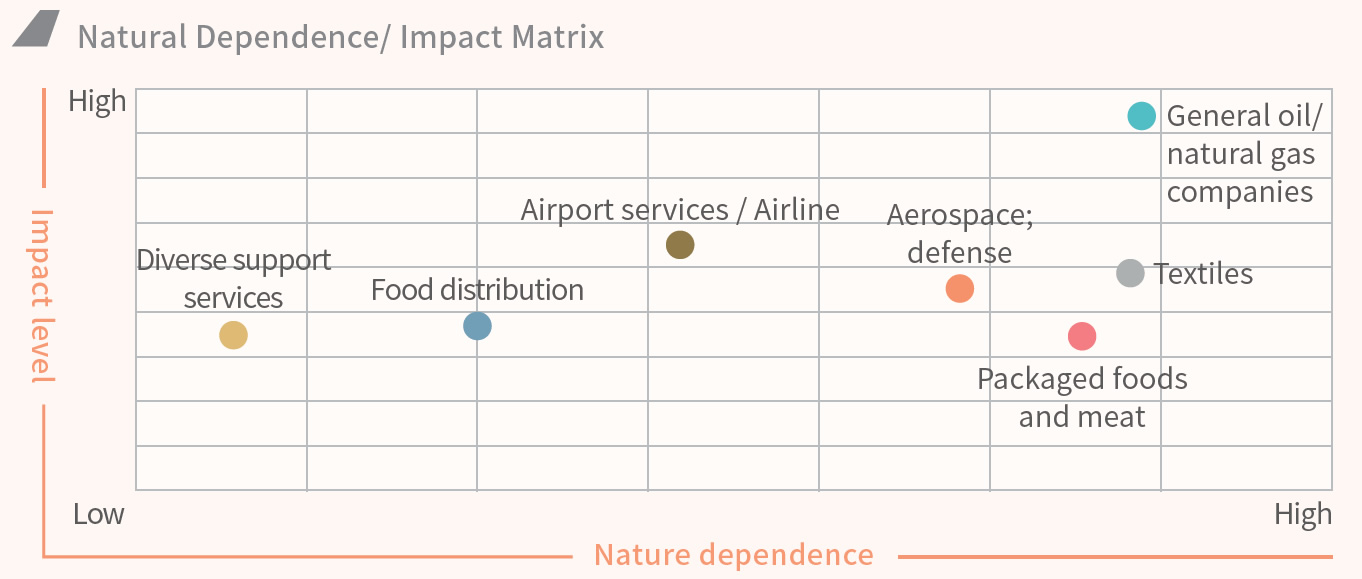

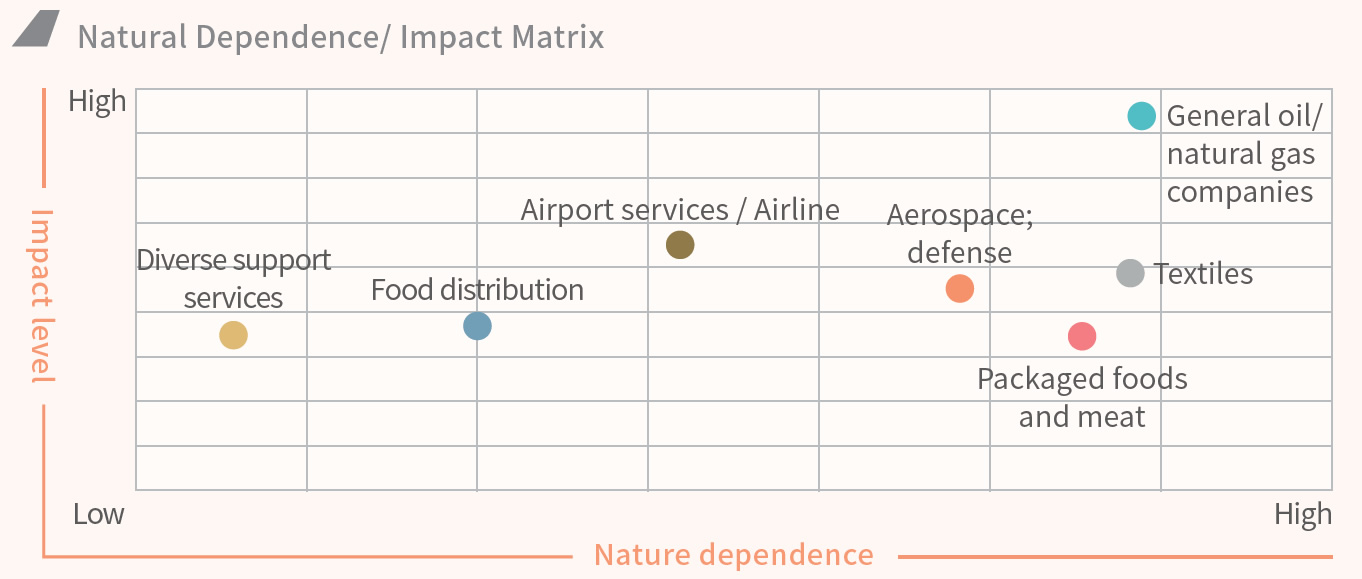

Through the four-phase LEAP approach, including Locate, Evaluate, Assess, and Prepare. Additionally, the Biodiversity Risk Filter tool developed by the World Wide Fund for Nature (WWF) was also adopted to assess dependence and impacts on nature in the Company’s business operations and value chain. Furthermore, information on policies, laws and regulations, and international initiatives related to the value chain was also collected to analyze potential nature-related risks and opportunities.

Considering international regulations/initiatives and identified aviation industry results, EVA Air identified three transition risks and three nature-related opportunities. Based on hotspots for dependence and impact on nature in regions where the Company and our key suppliers operate, we also identified two other physical risks. For all these nature risks and opportunities, we have formulated measures for risk mitigation and management to increase corporate resilience. To address transition risks, we pay close attention to policy, responsibility, and reputation issues, such as the use of certified SAF and strengthened enforcement against illegal wildlife trafficking. In terms of physical risks, we strengthen soil & water conservation risk management, with focus placed on reducing financial losses and environmental impacts.

Natural Dependence/Impact Driver Matrix

|

Operating Activities Categories

|

Relevant Sub-industries

|

Ranks

|

| Aviation Fuel |

General oil/natural gas companies |

1 |

| Aircraft Maintenance & Parts |

Aerospace; defense |

4 |

| Ground Handling |

Airport services |

5 |

| Cabin Service Supplies & Catering |

Food distribution |

7 |

| Packaged foods and Meat |

3 |

| Textiles |

2 |

| Operation Maintenance & General Affairs |

Diverse support services |

8 |

| Company’s Operations |

Airline |

5 |